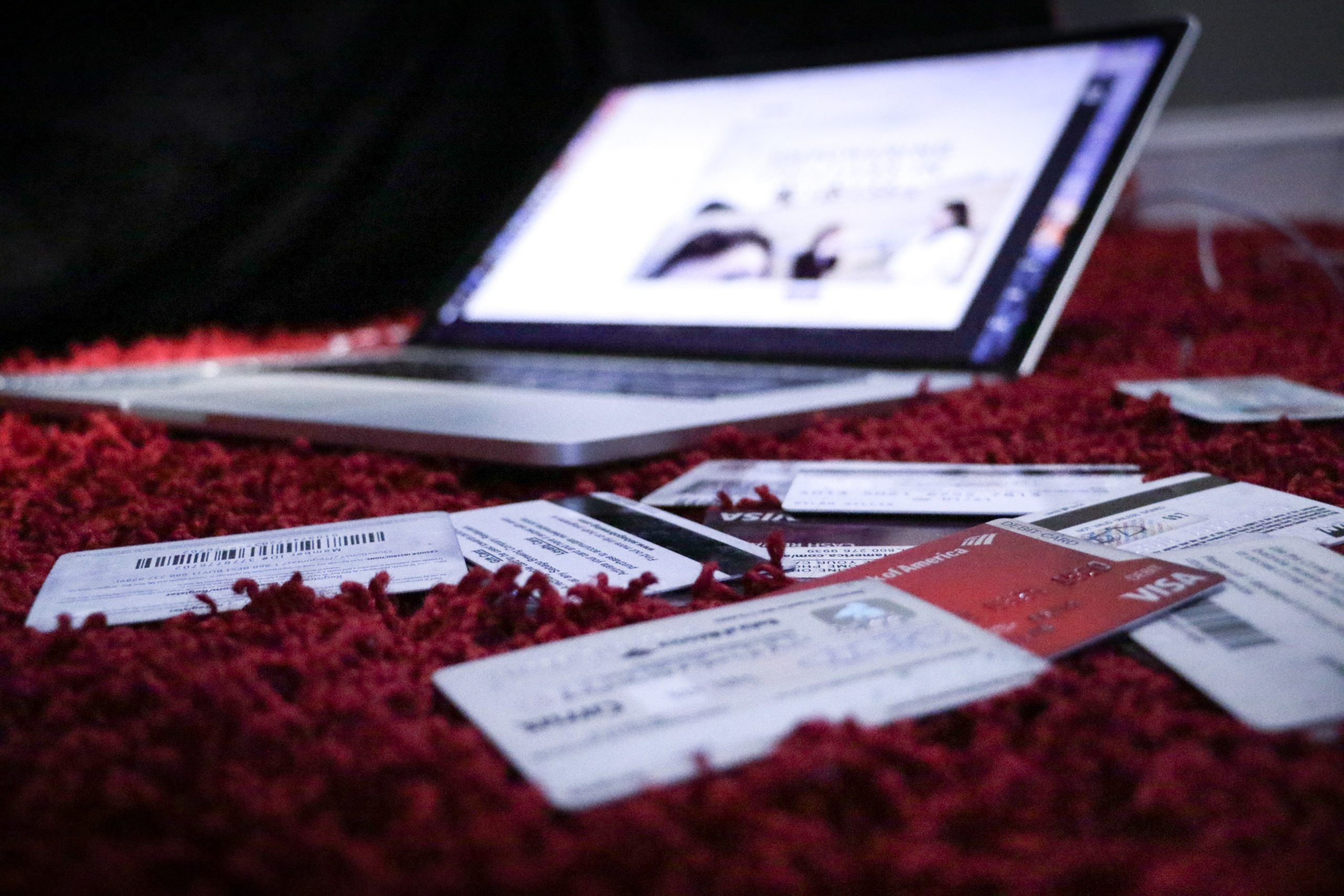

Can Employers Find Out About a Bankruptcy in New Jersey?

Depending on the situation, your employer can find out about a previous or current bankruptcy in New Jersey. That said, there’s not much to fear about an employer learning about your financial hardships.

Unless your employer is a creditor, they will likely not be informed of your decision to file for bankruptcy in New Jersey. However, an employer can still find out about a bankruptcy you consent to a credit check or if they run a public records check. Although bankruptcies only stay on credit reports for a specific amount of time, they are part of the public record forever. While your employer can find out about bankruptcy, they cannot retaliate. Any discrimination concerning your employment based on bankruptcy is not allowed in New Jersey.

Our attorneys are here to help New Jersey residents regain their financial stability by filing for bankruptcy. For a free case evaluation with the New Jersey bankruptcy lawyers at Young, Marr, Mallis & Deane, call today at (609) 755-3115.

How Can My New Jersey Employer Find Out About a Bankruptcy?

If you’ve recently filed for bankruptcy or have a bankruptcy on your credit report, you may be concerned that an employer will learn about your financial history. Generally, employers are not informed about an employee’s bankruptcy unless they are a creditor. While New Jersey employers may not be informed of a previous bankruptcy, they can find out about one under certain circumstances.

Creditor

When you file for either Chapter 7 or Chapter 13 bankruptcy in New Jersey, an automatic stay will go into effect. This will prevent all creditors from harassing you for debt collection while your North Jersey bankruptcy lawyer and the court devise a repayment plan. If your current employer is also a creditor, meaning you owe the business itself money, they will be informed of an automatic stay. This would mean that your employer could no longer ask about payments while you are under bankruptcy in New Jersey. It would also mean that your employer would know you have filed for bankruptcy.

Credit Check

If a New Jersey employer is interested in your financial history and wishes to learn more about it, they may ask you to consent to a credit check. In New Jersey, a potential employer must get an applicant’s written consent to a credit check before performing one. Depending on the position you are applying for, a prospective employer may be more or less likely to request a credit check in New Jersey.

If you do consent to a credit check, an employer may be able to find out about a previous bankruptcy. In general, a Chapter 7 bankruptcy can stay on your credit report for ten years after you file, and a Chapter 13 bankruptcy can stay on your credit report for about seven years.

Public Records Search

Bankruptcies are part of the public record. That means the court documents detailing your New Jersey bankruptcy will be available to virtually anyone who requests them. If an employer wishes to do a public records search, they may be able to find out about your bankruptcy in New Jersey.

Is it Likely that My Employer Will Find Out About Bankruptcy?

Unless your employer is also a creditor, they likely won’t be informed if you file for bankruptcy in New Jersey. In fact, it’s not likely that an employer will seek out such information at all unless you have a particularly high-stakes job.

An employer may be interested in your credit history if you work in the financial industry. That said, bankruptcy doesn’t indicate your ability to work hard or be a dedicated employee, so many New Jersey employers aren’t concerned with an employee’s financial history.

The more time that goes by, the less likely it will be that an employer will find out about a previous bankruptcy. Remember, bankruptcies only remain on a person’s credit report for about a decade. If many years have passed since you filed for bankruptcy in New Jersey, an employer won’t be able to see such information on your credit report if they ask you to consent to a check. If you’re unsure whether or not your bankruptcy is still on your credit report, ask a Piscataway bankruptcy lawyer for clarification.

While your bankruptcy case will always be part of the public record, it’s not very likely that an employer will deliberately search through court documents to find out about a previous bankruptcy. That can take effort and time that many employers don’t want to waste, as your financial history may be of little concern.

What Can Happen if My New Jersey Employer Finds Out About a Bankruptcy?

Although you may be embarrassed about a previous or current bankruptcy, there is little to fear regarding your employer’s response. While it is certainly possible for an employer to learn about bankruptcy, as such information is part of the public record, they can’t fire you upon finding out about your financial history

According to 42 U.S.C. § 525, employers are prohibited from retaliating against employees that have filed for bankruptcy. That means you can’t get fired or demoted after declaring bankruptcy in New Jersey. Inform your Trenton bankruptcy lawyer if your employer has found out about your financial hardships and then fired you. Any discrimination based solely on the fact that you have filed for bankruptcy is simply not allowed.

While filing for bankruptcy can be overwhelming and embarrassing for some New Jersey residents, it can also help them eliminate the debt holding them back. If you’ve put off filing for bankruptcy out of fear of what an employer might think, there’s no longer a need to do so.

Our New Jersey Lawyers Can Help You File for Bankruptcy Today

If you need assistance regaining your financial stability, our attorneys can help. For a free case evaluation with the Princeton bankruptcy lawyers at Young, Marr, Mallis & Deane, call today at (609) 755-3115.